|

Quick Fixes: PMFBY VLEs' FAQs at Your Fingertips |

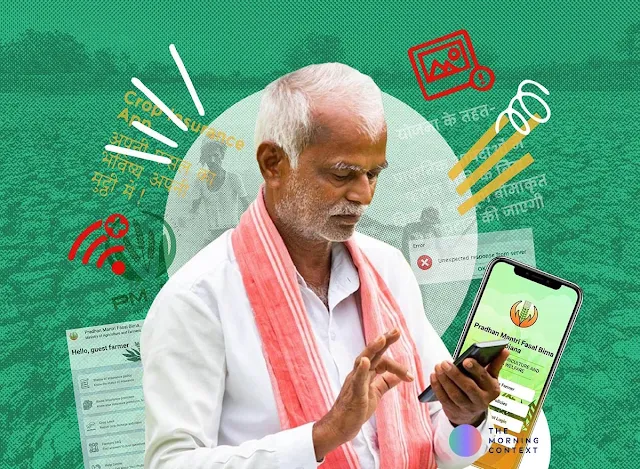

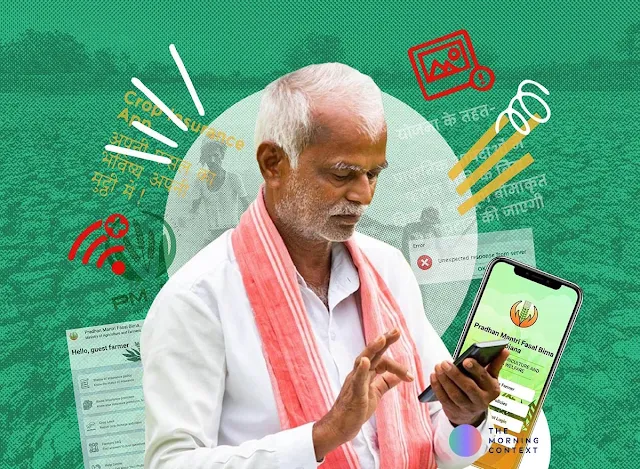

The Pradhan Mantri Fasal Bima Yojana (PMFBY) is a crucial crop insurance scheme introduced by the Indian government to provide financial security to farmers in times of crop failures or natural disasters. The success of the scheme heavily relies on the efforts of Village Level Entrepreneurs (VLEs) who assist farmers with the application process. In this comprehensive blog, we will delve into the frequently asked questions by VLEs and provide detailed answers to help them navigate through the process efficiently.

1) How much commission will VLEs receive from the Centre?

VLEs will receive a total commission of Rs. 32 for each submitted application, with 80% of the commission coming from the government and the remaining 20% from the Common Service Centre (CSC).

2) What is the last date for filing crop insurance applications?

The last date for submitting crop insurance applications is 31st July 2023.

3) Which documents should be uploaded for the application?

The necessary documents for uploading include the bank passbook, PikPera (crop-cutting report), 7/12 extract, or 8A extract.

4) Which document should be uploaded for 7/12 or 8A?

If the farmer owns the land, they need to upload the digitally signed 7/12 extract. However, if there are issues with the land ownership, such as site problems or tenancy agreements, the VLE should upload the Talathi's digitally signed verification and, in some cases, the 7/12 extract.

5) What if the Talathi's signature is not available?

If the Talathi's signature is unavailable, the VLE can take responsibility and upload an undertaking on behalf of the farmer.

6) If there are multiple land parcels (8A extracts), how should they be uploaded?

In case there are multiple land parcels, the VLE should compile all the 8A extracts into a single PDF file and upload it.

7) How should the bank passbook be uploaded?

The bank passbook should be uploaded in its original form, clearly displaying the branch manager's signature, IFSC code, and account number.

8) What documents are required for non-irrigated land (Samaik Kshetra)?

For non-irrigated land, upload the 7/12 extract and a consent letter. If there is a dispute regarding the land, obtain a tenant certificate from the tenant and upload it.

9) What to do if there are two joint account holders and only one is willing to apply (Samaik Kshetra)?

In such cases, one of the joint account holders who is willing to apply can submit the application. There is no restriction on the number of applications if the land is jointly owned.

10) Are Tripura and Puducherry available on the CSC dashboard?

Due to technical reasons, some areas like Tripura and Puducherry might not be available on the CSC dashboard. In such cases, the VLE should focus on regions available in Maharashtra.

11) What should be done if a farmer owns land in two separate villages (Shetkaryachi Zameen Don Shivarat Asel)?

For such cases, the farmer can submit two separate applications, as there is no limitation on the number of applications one farmer can submit.

12) How much money should VLEs collect from the farmers on behalf of the Centre?

VLEs should collect the farmer's share of the premium (Farmer Share) while providing the insurance receipt.

13) Who should pay for the 7/12 and 8A extracts?

The farmer should bear the expenses of obtaining the 7/12 and 8A extracts. However, for crop insurance, only a nominal fee of Rs. 1 is charged per document. These documents include 7/12 extract, 8A extract, Jharokha, PikPera, and others.

14) Where and when will the commission be credited?

The commission will be credited to the CSC Wallet or Digipay in the following month.

15) What if there are errors while filling out the application?

If any errors are found after submitting the application, the VLE can correct them by filling out a Google Form available on the CSC portal. The VLE needs to provide the Application Number and required details, and if approved, the application will be processed accordingly. In case of technical issues, the application may be rejected or reverted, and the VLE can resubmit a fresh application.

16) Can payment banks be used while submitting applications?

While submitting the application, VLEs should provide their bank's ADCC account number. If the ADCC account is not available, a nationally approved bank account such as India Post Payment Bank, Paytm Bank, or Fino Bank can be used.

17) What should VLEs do if they face technical difficulties related to insurance?

In case of any technical issues related to insurance, VLEs can contact the state coordinator through CSC DM. They can also join WhatsApp groups to stay updated on the latest information and resolutions.

18) What if the land is on lease or rent (Jamim Bhade Tatwavar Asel)?

For land on lease or rent, the VLE should upload the tenant certificate in the document section of the application.

19) What is the subsequent process after submitting the application?

After submitting the application, it will be reviewed by the Insurance Representative through the PMFBY portal. Once approved, if any technical issues arise, the application can be reverted for re-submission. To resolve such issues, VLEs need to attend meetings on the PMFBY portal at the right time, ensuring that the farmer does not suffer any financial losses.

Conclusion:

Village Level Entrepreneurs (VLEs) play a pivotal role in bridging the gap between farmers and the Pradhan Mantri Fasal Bima Yojana (PMFBY). By understanding and addressing the frequently asked questions and providing accurate information, VLEs can efficiently guide farmers through the insurance application process. This will not only safeguard the interests of the farmers but also contribute significantly to the successful implementation of the crop insurance scheme, ensuring financial security and stability for agricultural communities across the country.